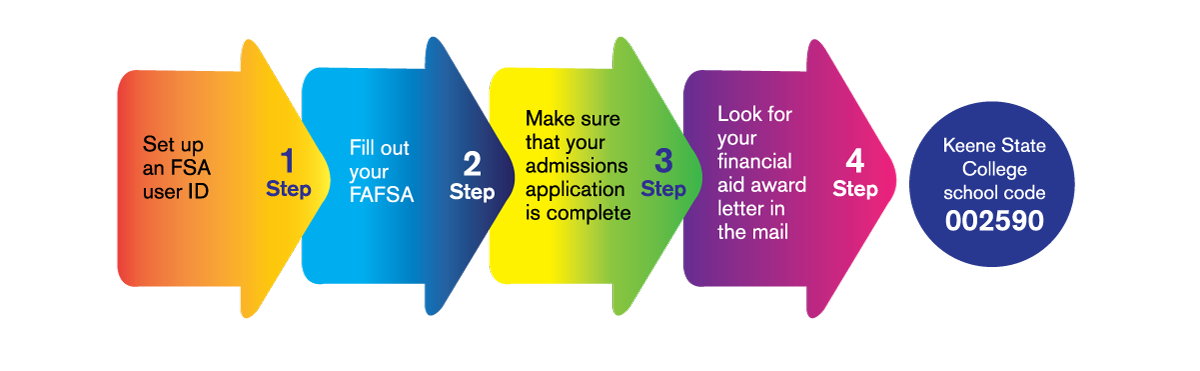

Take These Steps to Complete Your FAFSA

More than 95 percent of Keene State students receive aid from Keene State. Filing your Free Application for Federal Student Aid (FAFSA) really is free, and the very first thing you should do after applying to Keene State or even if you’re thinking about applying for admission. You can take this step now – no need to wait.

2024-25 FAFSA available December 2023

Step 1:

Set up an FSA user ID. Both you and your parent or guardian will need to do this so you can sign in separately.

Step 2:

After you and your parent or guardian have your IDs, fill out your FAFSA using Keene State’s school code of 002590. Fill out your FAFSA at https://studentaid.gov/.

The IRS uses tax return information from two years before the year you are submitting your information. For instance, if you are applying for aid to start in fall 2024, your family’s 2022 tax return information will be used. Also, the IRS has a tool for you and your family to use that will electronically transfer tax return information, called the DRT (data retrieval tool).

The online tool will make it simpler to move forward in the process and will help to be sure everything is accurate. If you need to submit tax return information without the online tool, you can enter it manually.

Your FAFSA information may be selected for verification to make sure it is accurate. What does this mean for you?

First of all, don’t worry! The federal government may randomly select your information, or Keene State could select your information if clarification is needed, in order to verify it for accuracy. Verification makes sure that you and other students receive the amount of financial aid for which you qualify.

If your FAFSA information is selected for verification, Keene State’s Financial Aid staff will send an email to you. Providing the requested documents as quickly as possible to our counselors will mean that your financial aid award can be determined faster.

Step 3:

Remember to make sure that your admissions application is complete, and you’ve been notified of your acceptance to Keene State, so that you can receive your aid award from us.

Step 4:

Next, Keene State will mail a letter to your home address that outlines the sources of your financial aid award. Your letter can arrive as early as January 2024, depending on how quickly you are notified about your acceptance to Keene State, and how early you complete the steps above. In your award letter will be instructions on what comes next in the financial aid process.

Completing the 24-25 FAFSA Presentation

Remember, it all starts by filling out your FAFSA with school code 002590.

Questions? Let us know! We’re here to help.